Self Insure Wisconsin® Empowers Employers

Customer Success Stories

Every employer is different for what they want and need, and it’s why Self Insure Wisconsin® customizes every group plan differently. Whether you have 10 or 500 employees, have locations just in Wisconsin or all over the country, Self Insure Wisconsin® will bring you a better employee benefits package. Here are some examples about how Self Insure Wisconsin® helps employers and employees get more control, savings, and transparency back for their group health plan.

Auto Dealer saves $900k/yr

Auto Dealer saves $900k/yr for the same coverage

A Wisconsin auto dealer with around 125 employees was facing yet again another struggling renewal increase. They were self insured and were for a long time, using a “legacy” national agency and vendors. There were multiple high cost claimants but nothing was being done to work with the employees, their providers, or proactive claims analysis.

Self Insure Wisconsin® sat down with all the ownership and discussed proactive ideas we could do for the high cost claimants, and picking the vendors. Months before even switching to Self Insure Wisconsin our consultants implemented two ideas to help get the best rates possible. Instead of talking about ideas, we actually quoted out their health plan and had an offer with a guaranteed savings of $900k less then what they were being shown by their national agency. We rolled out the program seamlessly to employees and employees had the same doctors, out of pocket, and coverage as before, with a massive savings to the group.

Challenges

Auto dealer was not getting the advice they needed from their “legacy” national agency on managing their claims and costs.

Ideas

Our consultants worked with the high costs claimants and quoted Self Insure Wisconsin’s proactive plans.

Results

There was a $900k a YEAR savings to the group and the employees kept their same doctors and out of pocket.

Saving a Church

Self Insure Wisconsin® brought ideas to save a church.

One of the largest churches in Wisconsin was facing a 54% increase to their current fully insured health insurance plan. The problem was there were multiple high cost specialty medications and conditions blowing up the rates. As with other non-profit organizations and churches, every dollar needs to go a long way. Employees want to focus on spreading the mission of the church, not on skyrocketing health costs coming out of their already stretched paycheck.

Self Insure Wisconsin® worked individually with employees to source high cost medications directly from the manufacturer and internationally. Which cut the renewal from a 54% increase to a 10% DECREASE from their current premiums by switching to Self Insure Wisconsin. Employees were all able to keep their same doctors, use the same prescriptions, and now had access to a $0 mobile clinic and 24/7 MD.

Challenges

The church received a 54% increase. The church and employees literally didn’t have the money to pay it.

Ideas

Our consultants worked directly with the employees taking high cost medications and sourced them at significant discounts.

Results

Employees paid NOTHING for the medications, the group switched carriers, and saved 10% instead of a 54% increase.

8% Renewal Decrease

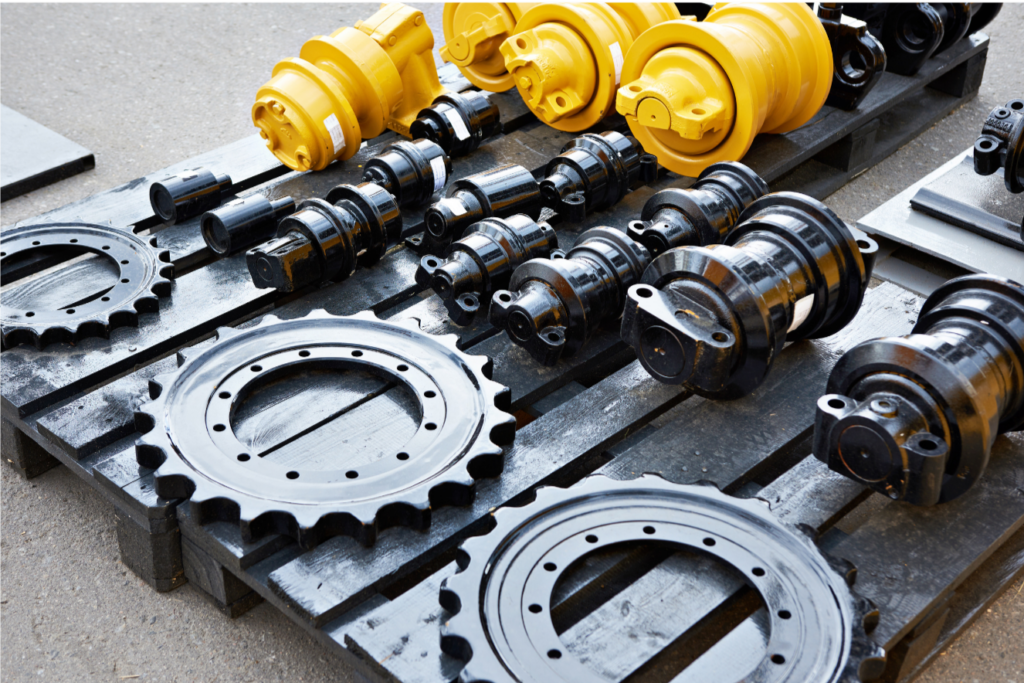

Truck parts company in 33 states gets an 8% renewal DECREASE.

A multi-state truck service company was facing another double-digit increase in their health insurance premiums. They were purchasing two more companies in other states and needed to combine all their policies into one at some point. They thought a big named national insurance company was the only answer, but their rates were skyrocketing and unsustainable.

Self Insure Wisconsin® had a solution of an open network plan that allowed employees to use lower cost providers and prescriptions throughout the entire country. The company went all in on the concept, leading from the top, and doing employee meetings and trainings. Their first renewal came back and the claims were calculated…..an 8% DECREASE to the renewal rates and a total savings of over $450,000 from the previous year’s renewal prices.

Challenges

Needed a national network to service employees and locations in 34 states, and were facing 28%+ increases from multiple insurance companies.

Ideas

Our consultants implemented a national transparency tool to get low cost providers and prescriptions covering all the states they needed.

Results

The group received an 8% DECREASE on their renewal premiums and saved over $450,000.

$0 Employee Out of Pocket Plan

12 location RV dealer gets $0 out of pocket plan.

The largest RV dealer in a 20 county radius had been with the same self funded health plan for over 25 years. They were self funded and seeing different “quotes” every year so they thought they were saving money. They learned really quick that not all self funded plans are set up to save the employer or employee money.

Self Insure Wisconsin® brought in all new fully transparent vendors including a new TPA, stop loss carrier, benefits agency, PBM, network, medical management, etc. We exposed what was causing their claims and premiums to be so high and developed a plan that allowed steerage to low cost providers and prescriptions. Which allowed all employees to have a plan with $0 out of pocket if they followed the InterceptCare® Nurse Advocate’s advice.

Stay Informed.

Subscribe to get immediate access to all new industry resources we release.